Nov 16, 2025

For professional services firms, a disorganized accounts receivable process is more than an administrative headache. It is a drag on operations.

While late payments are the visible symptom, the true costs are buried in strategic friction, margin erosion, and damaged client relationships.

Effective receivable management services are not a back-office function—they are a core driver of financial stability and control.

The True Cost of Inefficient Accounts receivable

Inefficient AR quietly drains resources. It manifests as unpredictable cash flow, forces difficult client conversations, and diverts finance teams to low-value administrative work.

This is not about chasing overdue payments. It is about establishing operational control over a critical financial process.

Consider a common scenario: A Controller at a growing consulting firm spends the last week of each month manually reconciling payments and chasing project managers for invoice details. The follow-up is inconsistent.

The outcome is a reactive, inefficient cycle that merely contains the problem rather than solving it.

The Financial Drag of Manual Processes

Manual AR processes introduce significant operational friction. Globally, businesses lose an estimated USD 600 billion annually to late payments, much of it due to administrative delays.

Nearly 50% of companies take 10-25 days just for internal invoice approval. This directly increases Days Sales Outstanding (DSO) and ties up working capital.

This drag creates compounding problems for a professional services firm:

Inaccurate Cash Flow Forecasting: Unpredictable payments make forecasting unreliable. This impedes confident budgeting for headcount, technology, or strategic investments.

Strained Client Relationships: Inconsistent or poorly timed collection calls can erode goodwill. A disciplined system ensures communication is professional and predictable.

Reduced Team Productivity: Finance team time is a high-value asset. Hours spent on manual follow-up are unavailable for financial modeling, budget analysis, or strategic planning.

To quantify the impact of payment failures, it is useful to understand drivers like credit card declined codes and revenue recovery tactics. Each failed transaction adds to the administrative load.

Ultimately, establishing control over accounts receivable transforms it from a source of friction into a strategic asset. It builds a predictable financial engine that enables growth.

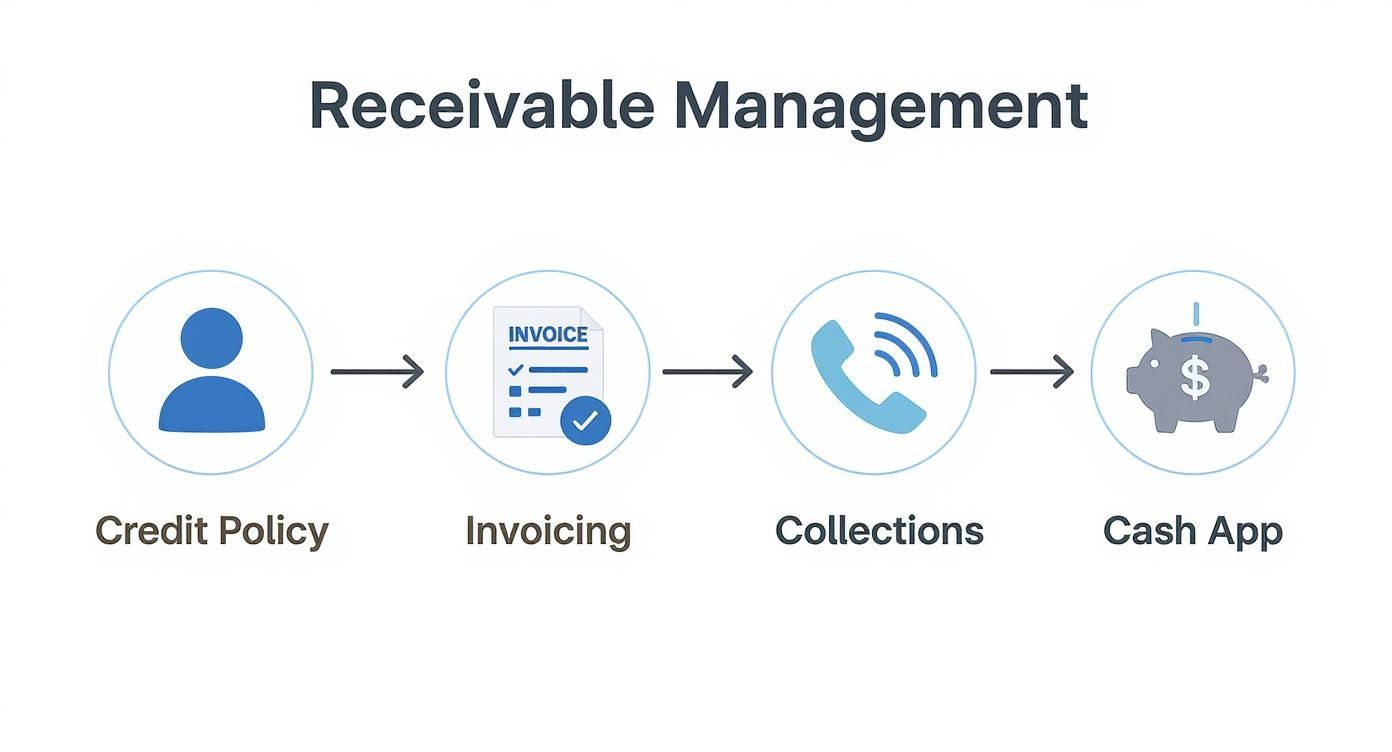

The Pillars of Modern Receivable Management

Effective receivable management is a system, not a checklist. For a professional services firm, this system must be precise.

Think of it as four pillars supporting your cash flow. If one is weak, the entire structure is unstable.

When these components work in concert, they create a clear path from engagement to payment, systematically eliminating friction.

Credit Policy and Risk Assessment

The most efficient way to collect on time is to extend terms to clients who pay on time. A formal credit policy is not about exclusion; it is about risk mitigation.

This means establishing clear, documented rules for payment terms. For a mid-sized firm, this could be as simple as a credit check for projects over $50,000 or requiring a retainer from new clients.

This single step establishes the foundation for a healthy financial relationship from the outset.

Invoicing and Billing Precision

In professional services, an invoice is a project's financial summary. Ambiguity is the primary cause of payment delays.

An invoice with unclear line items, a missing PO number, or vague submission instructions gives a client's finance department a valid reason to delay payment.

Precision is critical. Your billing process must ensure every invoice is:

Accurate: Matches the agreed-upon scope and rates.

Clear: Details the work delivered in language the client understands.

Timely: Sent as soon as work is complete or a milestone is achieved.

Correcting a single flawed invoice can delay payment by weeks. A disciplined billing process, supported by accounts receivable automation, eliminates these self-inflicted errors.

Proactive Collections and Outreach

Effective collections begin before an invoice is due. Modern receivable management is proactive, using a structured communication cadence to prevent payment delays.

This is not aggressive pursuit; it is professional, predictable outreach.

For example, an automated reminder three days before an invoice is due serves as a helpful prompt. This can be followed by a direct, professional email seven days after the due date.

This systematic approach, often managed by AI AR automation, ensures your firm remains a priority and signals strong operational discipline.

A proactive system removes the emotional and administrative burden from your team. It ensures every client receives consistent, professional communication, protecting both cash flow and the relationship.

Tools offering QuickBooks AR automation are essential here. They allow you to define communication cadences once and execute them reliably without manual intervention.

Cash Application and Reconciliation

The final pillar is closing the loop efficiently. Cash application—matching payments to open invoices—is a notorious time drain. A single wire transfer covering multiple invoices can create hours of manual reconciliation.

Modern AR software for professional services automates this matching process. This maintains a clean ledger and provides a real-time, accurate view of your cash position.

Getting this right is the final step to improve cash flow and maintain an accurate financial record.

Measuring the Impact on Your Financial Health

Finance leaders operate on data, not assumptions. Implementing receivable management services is about driving measurable improvement in the KPIs that define your firm’s financial stability.

The objective is to convert accounts receivable from a cost center into a predictable source of operational strength.

This transformation is measured in hard numbers: lower payment cycles, improved cash positions, and a finance team with capacity for strategic work.

Shrink Your Days Sales Outstanding (DSO)

DSO is the primary indicator of collections efficiency. For professional services firms, a high DSO is a constant drag on working capital. A systematic approach to receivables directly targets this metric.

Firms adopting accounts receivable automation typically see their DSO fall by 15-30% within six months. This is the direct result of replacing manual follow-ups with a disciplined, automated communication cadence.

An automated reminder three days before an invoice is due, followed by another seven days after, can shorten the collection cycle by 10-15 days. For a firm with $5 million in annual revenue, reducing DSO from 60 to 45 days frees up over $200,000 in cash.

Every component, from credit policy to cash application, works to shorten the time between invoicing and payment.

Make Your Cash Flow Predictable

For any CFO or Controller, unpredictable cash flow undermines strategic planning. Systematizing outreach transforms erratic payments into a reliable forecast.

This provides a data-driven view of incoming cash, enabling sharper financial modeling. AI AR automation can further enhance this by analyzing client payment behaviors to predict payment timing.

When your collections process operates on a predictable schedule, cash flow forecasting shifts from a reactive estimate to a proactive planning tool. This control is fundamental to scaling a services business.

This predictability enables strategic decisions backed by solid data, not assumptions.

Manual AR vs. Automated Receivable Management

Metric | Manual AR Process | Automated Receivable Management |

|---|---|---|

DSO | High and volatile (e.g., 60-90+ days). | Consistently lower (e.g., 45-55 days), reduced by 15-30%. |

Cash Flow | Unpredictable, hindering strategic planning. | Stable and forecastable, enabling investment. |

Team Efficiency | High manual effort; team spends hours chasing. | Over 80% of routine tasks automated; team focuses on exceptions. |

Reconciliation Time | Slow and error-prone, especially with complex payments. | Fast and accurate, with automated cash application. |

Client Experience | Inconsistent, sometimes awkward follow-ups. | Professional, timely, and consistent communication. |

The contrast is not merely about time savings; it is about building a more resilient financial foundation.

Give Your Finance Team Their Time Back

Your finance team's focus is its most valuable asset. Manual AR management consumes hours that should be allocated to high-value analysis and strategy.

Consider the time spent on manual tasks:

Chasing Overdue Invoices: An AR specialist can spend 15-20 hours per week on tracking, prioritizing, and sending reminders.

Applying Payments: Manually reconciling a single payment across multiple invoices in QuickBooks can take 30-45 minutes.

Reporting: Compiling AR aging reports is often a weekly, manual task.

AR software for professional services, including platforms with deep QuickBooks AR automation, can eliminate over 80% of this manual work. The system handles reminders, payment application, and real-time reporting.

This frees your team to manage exceptions, identify client payment trends, and contribute to financial strategy. That reclaimed time translates directly to the bottom line.

How to Integrate Automation into Your AR Workflow

Integrating accounts receivable automation is a deliberate process of layering technology onto your existing operations. The goal is not to replace your financial systems but to add a layer of control and consistency.

For most professional services firms, operations are centered on a platform like QuickBooks. A smart integration ensures the automation layer communicates seamlessly with your accounting source of truth.

Audit Your Current AR Process

Before optimizing a process, you must understand its current state. A thorough audit of your AR workflow identifies the specific bottlenecks that inflate DSO and reduce efficiency.

Pinpoint the most time-consuming tasks. Is your team spending 15-20 hours a week sending reminders? Or is the primary constraint manual cash application?

This audit provides a blueprint for your automation strategy, indicating where technology will deliver the greatest and most immediate impact. You can learn more in our guide to accounts receivable automation software.

Define Your Automation Rules

With bottlenecks identified, you can build the logic to resolve them. This involves creating simple "if-then" rules for communication and escalation.

Effective receivable management services are built on customizable rules, not generic templates. They should reflect your firm's communication style.

For example:

Rule 1: A professional reminder is sent 3 days before an invoice due date.

Rule 2: A direct follow-up is sent 7 days after the due date if unpaid.

Rule 3: Any invoice over $25,000 and 30 days overdue is flagged for a personal call from the account manager.

This creates a predictable, professional cadence that keeps your invoices top-of-mind without damaging the client relationship. For broader efficiency, consider automating company approval workflows for handling disputes.

Integrate with Your Accounting System

Data integrity is non-negotiable. Any AI AR automation platform must integrate deeply with your accounting software, particularly systems like QuickBooks.

This is typically managed via a direct, real-time API connection.

When an invoice is created in QuickBooks, it appears instantly in the AR platform. When a payment is recorded, that data is pushed back, closing the invoice and keeping your general ledger balanced.

Without seamless integration, an automation tool creates more problems than it solves. A robust QuickBooks AR automation connection is the technical backbone of a successful implementation, preventing data silos and manual reconciliation.

Train Your Team for Exception Management

The final step is to shift your team’s focus from execution to oversight. Automation handles the 80%—reminders, follow-ups, payment matching. Your team manages the 20% that requires human judgment.

This involves training them to:

Handle client replies and complex inquiries.

Intervene on high-value, at-risk accounts.

Analyze performance data to identify payment trends.

Refine automation rules based on performance.

This elevates your finance team from data entry to strategic process controllers. The ROI is significant, with 65% of businesses recouping their software investment within the first year.

Choosing the Right Receivable Management Partner

Selecting AR software is an operational upgrade, not just a technology purchase. It directly impacts cash flow, team productivity, and client relationships.

For professional services firms, project-based billing and complex client structures are standard. Generic tools often fail to accommodate these nuances.

The right partner understands this. They provide a framework for control, acting as a natural extension of your finance team rather than another system to manage.

Core Integration Capabilities

The first requirement is deep, two-way integration with your accounting system. For most firms, this means seamless QuickBooks AR automation. A shallow, one-way data pull is insufficient.

Look for a platform that:

Syncs in real-time: New invoices, customers, and payments in QuickBooks should appear instantly in the AR platform.

Maintains data integrity: Your accounting software must remain the single source of truth.

Handles complexity: The integration must support custom fields, project codes, and multi-invoice payments common in professional services.

Without this technical foundation, any promise of efficiency is unsubstantiated.

Customization and Control

Your firm's communication style is part of its brand. An AR partner that imposes rigid, robotic templates can undermine client relationships.

True control means shaping workflows to match your firm’s voice and cadence.

A platform should empower your strategy, not dictate it. The ability to tailor communication timing, tone, and escalation paths based on client tiers or invoice values is the difference between crude automation and intelligent orchestration.

In practice, this allows for a gentler follow-up for a strategic, long-term client, while a more standard cadence can be applied to transactional accounts. This level of control ensures automation strengthens, rather than strains, client partnerships. Understanding the nuances of accounts receivable outsourcing versus in-house automation is also valuable here.

Reporting and Strategic Analytics

Automating reminders is only half the solution. A valuable AR software for professional services must provide clear, actionable insights into performance.

Look for dashboards that track key metrics:

Days Sales Outstanding (DSO) trended over time.

Collection Effectiveness Index (CEI) to measure performance against receivables.

Client payment behavior to identify at-risk accounts proactively.

This data transforms AR from a reactive function into a proactive financial command center. It provides the information needed to refine credit policies, adjust client terms, and forecast cash with confidence.

Bringing Control to Your Receivables

Effective receivables management is about bringing clarity, consistency, and control to a core business process.

Moving from manual follow-ups to an automated system is a fundamental shift toward operational excellence.

When executed correctly, accounts receivable ceases to be a source of friction and becomes a predictable asset. Your finance team is freed from administrative tasks to focus on financial strategy.

Most importantly, it delivers the steady cash flow required to hire talent, invest in growth, and plan with confidence.

The Path to Financial Control

Mastering your AR process is an achievable goal with a significant payoff. The right receivable management services provide the framework to reduce DSO, improve cash flow, and bring a new level of precision to your finances.

For practical next steps, review our strategies for cleaning up your accounts receivable.

Ultimately, control over AR builds a more resilient and predictable business. It ensures the value you deliver to clients is consistently converted into the cash required to operate and grow.

The global AR software market is projected to grow from USD 3.5 billion to over USD 7.7 billion, demonstrating the strategic importance firms place on solving cash flow and efficiency challenges. You can read more on these market trends.

Achieving this clarity is a competitive advantage. It builds the disciplined financial foundation that supports your firm's strategic objectives while protecting client relationships.

Common Questions from Firm Leaders

Finance leaders at professional services firms typically have sharp, practical questions about receivable management. Here are the most common inquiries.

How Does This Actually Work with QuickBooks?

Think of accounts receivable automation as an intelligent layer that sits on top of your accounting system. These platforms integrate directly with software like QuickBooks via a secure, real-time API connection.

The data flow is two-way. The platform pulls open invoice data to run your defined follow-up sequences. When a client pays, that information is pushed back into QuickBooks, automatically closing the invoice. Your general ledger remains the single source of truth.

A proper QuickBooks AR automation integration does not compete with your accounting system—it completes it. It automates outreach while keeping your financial records perfectly synchronized in the environment your team already uses.

The objective is seamless data flow, allowing your team to focus on exceptions, not administration.

Will Automation Hurt Our Client Relationships?

This is the critical question for any professional services firm. Effective AR software for professional services is designed around a "human-first" principle for this reason.

You remain in complete control of the process.

You define the tone: All communication is fully editable to match your firm's voice.

You control the timing: High-value partners can receive a different, softer follow-up sequence than new clients.

You decide where to draw the line: The system handles the 80% of predictable follow-ups, freeing your team to apply a personal touch to the complex 20% of cases requiring a conversation.

This consistency often strengthens relationships. Clients appreciate professional, predictable communication from a well-organized firm.

What’s a Realistic Timeline for Reducing Our DSO?

While every firm's starting point differs, a measurable drop in DSO should be visible within the first 60 to 90 days as the system addresses older, overlooked invoices.

Following this initial phase, a sustained DSO reduction of 15-30% within six months is a realistic target. This improvement stems from the relentless consistency of an automated system.

Is This Actually Cost-Effective for Our Firm?

For a growing services firm, the ROI is typically clear and compelling. The calculation must include the significant "soft costs" of manual processes.

A finance team member spending 15-20 hours per week on manual follow-up is a substantial productivity drain. When the carrying cost of delayed payments is added, the financial case becomes even stronger. AI AR automation virtually eliminates this administrative burden.

By accelerating cash collection, you directly improve your cash flow and working capital. Most firms find the service pays for itself and delivers a positive ROI within the first year.

Resolut automates AR for professional services—consistent, accurate, and human.